main street small business tax credit self-employed

The deduction starts to phase out if your expenditures exceed 60000. The credit is limited to 500or 50 of your startup costs.

Covid 19 Relief Statewide Small Business Assistance Pa Department Of Community Economic Development

So if the LLC ownerself-employed individual is the only worker associated with the business it can not claim the tax credit.

. From government tax credits to treasury management to exclusive savings on the tools you use every day we save you thousands of dollars hundreds of hours and countless headaches. New Entrepreneurs and Existing Small Businesses Small Business and Industry Organizations Tax Practitioners with Small Business Clients Topics include. For tax years beginning in 2010 businesses are allowed to deduct up to 10000 of business start-up costs--thats double the previous 5000 limit.

Employees who work at least 120 hours and no more than 400 hours per year. This means that a 1000 tax credit saves you 1000 in taxes. Small Business tax credits provide a dollar-for dollar reduction of your income tax liability.

The credit applies to California small businesses that. Main Street Small Business Tax Credit Special Instructions for Sales and Use Tax Filers. Unused credits may be carried over for 5 years or until.

A document published by the Internal Revenue Service IRS that provides information on how taxpayers who use. Its a program for small employers self-employed individuals and gig economy workers with 350 billion to help prevent workers from losing their jobs and small businesses from going under due to economic losses caused by the COVID-19 pandemic. 517 Grand Street Floor 1 New York NY 10002.

A 100 deduction reduces taxable. The Impact of Retail in Southwest Minnesota. Visit Instructions for FTB 3866 for more information.

House Small Business Committee Hearings And Meetings Video Congress Gov Library Of Congress 1101 4th Street SW Suite 270 West Washington DC 20024 Phone. The self-employment tax rate is 153 of net earnings. You can claim it for the first three years.

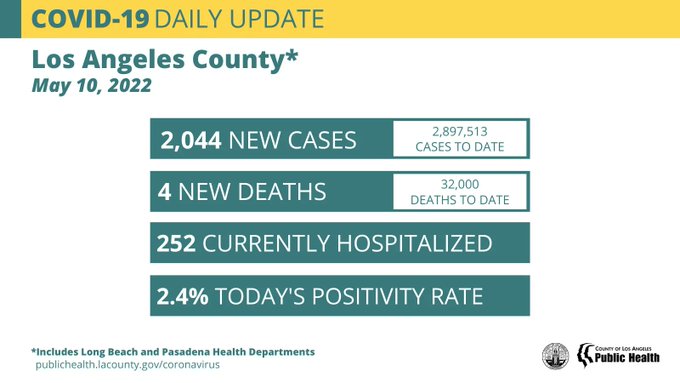

This is a small business tax credit designed to offset the costs of starting a pension. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers. Small business tax prep File yourself or with a small business certified tax professional.

Find Small Business Expenses You May Not Know About And Keep More Of The Money You Earn. Business Income Tax Returns. Link is external This FREE one-hour audio webcast is for.

Unused credits may be carried over for 5 years or until. IRS Publication 587. Resources for taxpayers who file Form 1040 or 1040-SR Schedules C E F or Form 2106 as well as small businesses with assets under 10 million.

On November 1 2021 the California Department of Tax and Fee Administration will begin accepting applications for tentative small business hiring credit reservation amounts through our online reservation system. State Small Business Credit Initiative. The Main Street Small Business Tax Credit II will provide Covid-19 financial relief to qualified small business employers.

That rate is the sum of a 124 Social Security tax and a 29 Medicare. Employed 500 or fewer employees as of December 31 2020 and. Your choice not to claim a deduction or credit conflicting tax laws or changes in tax laws after.

Visit Instructions for FTB 3866 for more information. Small Employer Pension Plan Startup Costs Credit. Self-employed individual or small-business owner.

Find out how to apply and if your small business qualifies by visiting our. EB-5 Immigrant Investor Program. Provides an assignable 25 tax credit for film video or digital media projects that expend at least 1000000 in eligible production costs.

You will be able to apply your credits against your sales and use tax liabilities for reporting periods starting with returns originally due on April 30 2021 and subsequent returns until they are exhausted or until April. Tax credits of 40 of first-year wages up to 600000 or 240000. Earned Income Tax Credit EITC Who qualifies.

You can deduct any start-up costs that are not immediately deductible over 15 years. Experienced a decrease of 20 percent or more in income tax gross receipts by comparing specified periods. The Earned Income Tax Credit provides a tax break to people who are employed but still earn low to moderate income.

Provide the confirmation number received from CDTFA on your Tentative Credit Reservation when claiming these credits. DEED Training Grant Programs. Employees who work 400 hours or more per year.

Tax credits for small business owners. The PPP provides forgiveness for small business loans for keeping employees. Credits are limited and available on a first come firstserved basis.

MainStreet takes a holistic approach to small business management so you can grow your business smarter not harder. A tax credits tax savings comes at face value. Get help with self-employment tax questions from the experts at HR Block.

Your Main Street Small Business Tax Credit will be available on April 1 2021. Tax credits of 25 of first-year wages up to 600000 or 150000. Ready to get started.

The PPP provides 8 weeks of cash. Reporting profit or loss from a business or profession Self-employment tax and estimated tax payments. Find information about filing and staying organized for tax season.

Business Use of Your Home Including Use by Day-Care Providers. Qualified small businesses had the option to elect to claim up to 250000 for research activities as a payroll tax credit in the form of a refund. How To Write Off Sales Taxes Turbotax Tax Tips Videos Turbotax Home And Business 2021 Fed Efile State Cd Or Digital Download Sam S Club.

Include your Main Street Small Business Hiring Credit FTB 3866 form to claim the credit. Many small business owners leave it up to their accountant to sniff out tax savings. Its actually one of the most common self-employment tax deductions.

Below youll find the most common tax credits used by small business owners like yourself. On the other hand small business tax deductions lower your taxable income and they are equal to the percentage of your marginal tax bracket. Use credit code 240 when claiming the credit.

The impact of a small business tax deduction is the deduction amount multiplied by your effective tax rate. Home RD Tax Credit Benefits for Self-Employed Business Owners.

Main Street Program Business Utah Gov

Mainstreet Rise Main Association For Enterprise Opportunity

Mainstreet Rise Main Association For Enterprise Opportunity

States And Local Governments Can Help Protect Workers And Small Businesses From The Economic Impacts Of The Coronavirus Center For American Progress

How Covid 19 Is Affecting Small Businesses In D C D C Policy Center

What Are State Sales Taxes Turbotax Tax Tips Videos

J K Lasser S Small Business Taxes 2022 Your Complete Guide To A Better Bottom Line Wiley

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Mainstreet Rise Main Association For Enterprise Opportunity

Mainstreet Rise Main Association For Enterprise Opportunity

Publication 531 2021 Reporting Tip Income Internal Revenue Service

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

15 Popular Deductions To Reduce Your Self Employment Taxes Forbes Advisor

Main Street Program Business Utah Gov

Main Street Program Business Utah Gov

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos